SEBI's "Spring Cleaning": Reforms to Boost Investment and Ease Business in India

A detailed explainer into the latest reforms carried out by the SEBI and their overall impact on Indian Economy.

The Securities and Exchange Board of India (SEBI) recently announced a slew of reforms aimed at improving the ease of doing business in India’s financial markets at the conclusion of its 210th board meeting on 18th June 2025. These reforms come at the back of Shri Tuhin Kanta Pandey’s (former Finance Secretary) appointment as the Chairperson of SEBI on 1st March 2025 and are a part of the Government’s wider agenda of moving towards an optimal regulation framework. The reforms are expected to make it easier for foreign investors to invest in Indian markets, enable institutional investors to make additional investments easily, make it easier for public sector undertakings to delist, and support startups wanting to list their equity shares on Indian stock exchanges. SEBI is actively working to "weed out those (policies) which are outdated and rationalise those which may be necessary" to reduce compliance burden and costs.

I. Reforms for Startups -

Context: Until recently, Startups in India were usually incorporated in foreign jurisdictions, primarily Singapore to escape heavy regulation and ease funding availability. Eventually when they got bigger and wanted to list their equity shares in the public market, they would prefer listing in the US, e.g. MakeMyTrip is listed on the NASDAQ. However, this trend has seen a reversal and Startups are deciding to list on Indian stock exchanges instead. This trend is called ‘reverse flipping’ and is something that has been a priority for the Government and SEBI.

CCS Shares Eligible for Minimum Promoters’ Contribution Exemption

Why Investors Prefer CCS: Compulsorily convertible securities (CCS) are hybrid financial instruments; such as debentures or preference shares that must be converted into equity shares of the issuing company by a specified date and at a predetermined ratio. These instruments offer investors fixed returns (like interest or dividends) until conversion, after which they become shareholders in the company.

Present Framework: According to Regulation 14 of the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018, (ICDR), the promoter’s minimum contribution to the post listing shareholding of the issuer should be at least 20% (MPC). However under the present framework, the equity shares arising out of CCS were ineligible to be considered MPC for certain investors such as Alternative Investment Funds (AIFs), foreign Venture Capital funds (VC), scheduled commercial banks, etc. SEBI has decided to reverse this position thus easing conditions for reverse flipping.

Enabling Exit For Investors: SEBI has also decided to exempt the requirement of a minimum one year holding period for equity shares arising out of conversion of CCS to enable investors to participate in and take advantage of the ‘Offer for Sale’ portion of the IPO. This will likely increase liquidity for institutional investors including VCs, PE funds, and AIFs leading to an improved investment climate.

Promoters Eligible To Hold ESOPs Post Listing

Present Framework: At present, promoters and founders classified as promoters are ineligible to hold or be granted share based benefits, including Employee Stock Options (ESOPs) at the time of filing of the draft red herring prospectus (DRHP). In case they do, they are required to liquidate such benefits, i.e. exercise these options to convert them into equity shares or have these ESOPs be bought back in a buyback scheme.

Flexibility For Founders: The change approved by SEBI will allow promoters to now continue holding ESOPs granted at least a year prior to filing or keep exercising any other benefits. This move is in line with the Government’s vision of enabling startups to list in Indian Stock Exchanges.

II. Reforms To Increase Transparency -

A. Mandate Dematerialisation of Existing Securities of Select Shareholders Prior To Filing Of DRHP:

In addition to the shares of the Promoter, SEBI has mandated the dematerialisation of securities of the following entities:

Promoter Group

Selling Shareholders

Key Managerial Personnel (KMPs)

Senior Management

Qualified Institutional Buyers (QIBs)

Directors

Employees

Shareholders with special rights

All entities regulated by Financial Sector Regulators

Any other category of shareholders as may be specified by SEBI from time to time

Streamlining the IPO Process: This mandate will likely reduce the chaos in the time period between filing of the DRHP and the filing of the updated DRHP, and prevent foul play by forgers to avoid any controversies and litigation with respect to ownership of shares that usually delays the process of IPO.

B. Simplification of Associated Persons Certification Regulations:

Amendment By Circular Instead of Notification: SEBI has proposed to amend the provisions of SEBI (Certification of Associated Persons in the Securities Markets) Regulations, 2007 (“CAPS Regulations”) to simplify the process of altering the certification requirements of ‘Associated Persons’ by amending the regulations to provide the certification through a circular instead of a notification in the official gazette.

‘Associated Persons’ are principals or employees of those organizations that are involved in the securities business and are regulated by SEBI.

III. Reforms For Ease Of Doing Business -

A. Amendments to regulatory framework for Social Stock Exchange for Ease of Doing Business:

Social Stock Exchange, A Failure: SEBI has eased fundraising norms for Social Enterprises (both for-profit and non-profit organizations (NPOs)) by making key amendments to the ICDR. The aim of these changes is to promote the Social Stock Exchange mechanism which has largely been a failure in India. The reasons for failure of the Social Stock Exchange mechanism are largely due to limited funding of charitable initiatives, decline of DEI investing, and pre-existing Corporate Social Responsibility (CSR) & funding relationships of major organisations. Additionally, many conglomerates prefer to use their in-house CSR initiatives instead of funding external organizations to maximise the public attention for their benefit.

Reducing Burden To Spur Social Stock Exchange: Most of these amendments are to reduce the regulatory burden of social enterprises. The key changes that have been instituted include, among other things:

Including trusts registered under Indian Registration Act, 1908, charitable society registered under the society registration statute of the relevant state and companies registered under section 25 of the erstwhile Companies Act, 1956, within the definition of NPOs. This allows these organizations to access the Social Stock Exchange and raise funds for their activities.

Redefining Social Impact Assessment Firms to Social Impact Assessment Organizations (SIAOs) and creating a new framework where these organizations are required to be empanelled with other self regulating organizations such as ICAI, ICMAI, etc,

Mandating social enterprises to raise funds through the Social Stock Exchange two years within registration or risk revocation of their registration with the exchange.

Expansion of eligible activities for social enterprises to mobilize funds by aligning activities with activities listed in Schedule VII of Companies Act (as governs CSR activities of companies).

SEBI can specify more target segments for inclusion under the eligibility criteria for being identified as a social enterprise. The existing target segments are underserved or less privileged population segments or regions recording lower performance in the development priorities of central or state governments.

Easing eligibility criteria for NPOs by limiting the criteria of certain percentage of activities compulsorily to be in eligible activities only to for profit social enterprises (from an earlier requirement covering both NPOs and for-profit social enterprises).

Bifurcation of the annual disclosure requirements into financial and non-financial matters, and prescribing different timelines for disclosures for these matters.

NPOs are permitted to self-report the annual impact report for its projects even when funds have not been raised through the Social Stock Exchange.

B. Relaxation In Regulated Entities Regulations:

More Flexibility For Market Participants: Previously, Merchant Bankers (MBs), i.e. the investment bankers who carry out market issues had to hive off divisions conducting activities not regulated by SEBI into different legal entities. SEBI has reversed this position and allowed MBs to conduct these activities not regulated by SEBI within the same legal entity with a few restrictions provided they are fee-based, non-fund based activities and pertain to the financial services sector.

Similar Freedom For Debenture Trustees and Share Custodians: Additionally, in case these activities are such that they are regulated by other financial sector regulators such as RBI, IRDAI, etc., the MBs need to be in compliance with these other regulators. SEBI has also allowed similar exemptions for Debenture Trustees (DT) and Share Custodians.

Dual Categorisation of Merchant Bankers: The other changes in the MB Regulations pertain to creation of a dual category of MBs based on net worth and activities, requirement to maintain liquid net worth of at least 25% of minimum net worth requirement at all times, restrictions on handling issues where KMP of MBs have a stake exceeding certain thresholds, and specifying criteria for appointment of compliance officers.

Clarifying Debenture Trustee Regulations: Additional changes in the DT regulations include: introducing explicit provisions to define the rights of DTs and corresponding obligations for issuers under the Listing Obligations and Disclosure Requirements, 2015 (LODR); addressing the current lack of clarity that hampers DTs in fulfilling their duties; enabling standardized formats for model Debenture Trust Deeds (DTDs) to ensure uniformity, as existing regulations only provide broad principles; and clarifying the permitted uses of the Recovery Expense Fund (REF) to resolve issues DTs face regarding expense approvals and reimbursements. These proposals, developed after public consultation and industry deliberation, aim to make compliance easier for DTs while mitigating risks from unregulated activities by SEBI-registered entities.

Improving Competition And Enabling Cooperation: These changes are likely going to improve the margins of these regulated entities and improve competition within the market. They might also spur a wave of consolidation within the industry that might increase risks.

C. Review Of Regulatory Framework for Angel Funds:

Mandatory Accreditation for Angel Investors and Broader Investor Pool: A key change is the mandate for Angel Investors to be Accredited Investors (AIs). This ensures that only investors with a verified risk-taking capacity participate, addressing the current lack of independent verification and updating outdated economic thresholds for angel investors. To facilitate a wider pool of eligible investors while adhering to the Companies Act, AIs will now be included as Qualified Institutional Buyers (QIBs) for the limited purpose of investing in Angel Funds. Previous non-AI investments will be grandfathered, with a one-year transition period for full implementation of these new measures.

Enhanced Operational Ease and Flexibility for Angel Funds: The revised regulatory framework also introduces several measures to enhance operational ease, clarity, and fairness within Angel Funds. For business ease, the investment floor and cap for an investee company have been relaxed significantly, moving from INR 25 lakh–10 crore to INR 10 lakh–25 crore. The concentration limit of 25% of total investments in a single investee company has been removed, and Angel Funds can now accept contributions from over 200 AI investors in an investment.

Fair Opportunity Allocation and Follow-On Investments: Additionally, follow-on investments in companies that are no longer classified as startups are now permitted. To ensure fairness, Angel Funds must offer every investment opportunity to all investors and allocate investments among consenting investors as clearly disclosed in their Private Placement Memorandum (PPM).

Accountability and Stakeholder Consultation in Angel Fund Operations: Furthermore, to promote accountability, sponsors/managers are now required to maintain a minimum continuing interest in each investment of the Angel Fund, set at the higher of 0.5% of the investment amount or INR 50,000. These proposals are the result of extensive consultations with industry stakeholders and advisory committees.

D. Simplifying Disclosure Document Format For Portfolio Managers:

Streamlining Disclosure Documents for Portfolio Managers: SEBI has approved an amendment to the SEBI (Portfolio Managers) Regulations, 2020, to simplify and improve the Disclosure Document for investors. Previously, the detailed format of this document was embedded within the regulations themselves (Schedule V). Any changes to this format required a formal amendment to the regulations, a time-consuming process.

Enhanced Operational Efficiency and Clearer Investor Information: To address this, SEBI has decided to remove the model disclosure document format from the regulations and instead issue it through a circular. This change, made in consultation with the Association of Portfolio Managers in India (APMI), will not alter the content of the disclosures. However, it will significantly enhance operational convenience for Portfolio Managers.

Two-Part Document Structure for Dynamic and Static Content: They will now be able to circulate only the updated "dynamic" section of the document, which contains frequently changing information, rather than the entire document. The document will be split into two parts: Dynamic (frequently changing content) and Static (less frequent changes).

SEBI's Commitment to Ease of Business and Information Dissemination: This restructuring aims to provide investors with clearer, more easily digestible information, allowing them to quickly identify any material changes in communications from their Portfolio Managers. This move is part of SEBI's ongoing efforts to facilitate ease of doing business for Portfolio Managers and improve information dissemination to investors.

E. Settlement Scheme For Stock Brokers Who Traded on NSEL:

SEBI Introduces Settlement Scheme for NSEL Stock Brokers: SEBI has launched a Settlement Scheme under its Settlement Proceedings Regulations, 2018. This scheme is specifically for certain Stock Brokers who had traded on the National Spot Exchange Ltd (NSEL) platform and were either registered or had applied for registration with SEBI as Trading or Clearing Members. The primary goal of this scheme is to offer these brokers an opportunity to settle ongoing enforcement actions taken by SEBI, leading to an expedited conclusion of these proceedings.

Settlement Terms, Monetary and Non-Monetary Conditions: The scheme includes both monetary and non-monetary terms of settlement. The monetary settlement amount is determined by a slab structure based on two criteria: the quantity of units involved in paired contracts and the traded value in paired contracts. For example, quantities up to 25,000 units incur a settlement amount of INR 100,000, with increasing slabs thereafter, up to a maximum of INR 500,000. Additionally, a basis point (0.01%) of the traded value in paired contracts is added, with a minimum of INR 5 lakh.

Eligibility and Exclusions for the Settlement Scheme: The non-monetary terms involve a voluntary debarment period ranging from 1 to 6 months, depending on previous suspension or cancellation directions. Any debarment period already served will be deducted. It's important to note that the scheme is not applicable to brokers named in charge sheets filed by law enforcement agencies like the Economic Offenses Wing or Enforcement Directorate in the NSEL matter, or those who are defaulters at stock exchanges.

Benefits and Limitations of the NSEL Broker Settlement Scheme: Furthermore, if a charge sheet is filed against a settled broker in the future, their settlement will be void. This scheme exclusively addresses violations of securities laws and does not impact investigations by other law enforcement agencies. SEBI anticipates that this scheme will significantly reduce regulatory costs, save time and effort, and serve as an effective deterrent without lengthy litigation. For brokers not eligible or those who choose not to avail the scheme, enforcement actions will continue as per law.

F. Settlement Scheme For Migrated VC Funds:

One-Time Settlement Scheme for Venture Capital Funds (VCFs): SEBI has introduced a one-time Settlement Scheme for Venture Capital Funds (VCFs) that failed to wind up their schemes within the stipulated timeframes. This scheme offers a settlement opportunity to VCFs that have already completed their migration to the SEBI (Alternative Investment Funds) Regulations, 2012 (AIF Regulations).

Settlement Terms: The settlement amount for VCFs consists of two parts: a fixed sum for delays in winding up (INR 1,00,000 for up to one year of delay, plus INR 50,000 for each subsequent year or part thereof) and a variable amount ranging from INR 1 lakh to INR 6 lakhs, based on the cost of unliquidated investments as of their migration application date.

Investment Manager or Sponsor to Bear The Cost: To be eligible, VCFs must have already migrated to the AIF Regulations. Crucially, the Investment Manager or Sponsor will bear all settlement costs and related expenses, ensuring no additional burden on investors. The deadline to be eligible to apply for this scheme is January 19, 2025 (i.e. 6 months from last date to apply for migration).

Addresses Challenges Faced By Investors: This scheme addresses the challenges VCFs faced in liquidating investments within their original scheme tenures. While migrating to AIF Regulations provides VCFs with additional time to liquidate assets and wind up schemes, it does not absolve them of past delays. This settlement scheme, recommended by SEBI's High Powered Advisory Committee, aims to quickly resolve past non-compliance related to scheme tenure, benefiting the entire ecosystem by reducing regulatory costs and avoiding lengthy litigation.

G. Reducing Compliance Burden For Listed Entities:

Mandatory Dematerialization for Corporate Actions under LODR: A key change in the LODR mandates that listed entities can now only issue securities in dematerialized form when undertaking corporate actions such as the consolidation or split of face value of securities and schemes of arrangement. This move aligns with SEBI's long-standing objective to promote dematerialization, recognizing its numerous benefits, including reduced fraud, elimination of physical damage or loss of securities, faster transfers, enhanced transparency, and lower costs for investors and companies.

Previous Efforts and Prevention of Physical Securities Creation: Previous efforts, including collaborations with companies holding a large number of physical securities, have already made significant strides in this direction. This new mandate prevents the fresh creation of physical securities during these corporate actions.

Amendments to Proof of Delivery Requirements in LODR: In a separate but related amendment, SEBI has modified certain provisions within the LODR Regulations to align with the current regulatory landscape. Specifically, it has deleted the requirement for listed entities to maintain proof of delivery under Para B(1) and B(2) of Schedule VII. These provisions previously mandated proof of speed post delivery for intimations regarding minor or major signature differences during security transfers.

Rationale and Impact of the Compliance Simplification: This requirement has been deemed redundant because listed entities already maintain proof of dispatch, and speed post or courier services generally retain proof of delivery records for up to six months. This modification, which followed a public consultation in January 2025, aims to further simplify compliance for listed entities without compromising investor protection.

H. Easing Deposit Requirements For Investment Advisers and Research Analysts:

In a move to ease the burden for Investment Advisers (IAs) and Research Analysts (RAs), SEBI has approved the use of liquid mutual funds and overnight funds to meet their mandatory deposit requirements. Previously, IAs and RAs were required to maintain this deposit solely in a bank fixed deposit (FD), lien-marked to their respective Administration and Supervisory Body (ASB). However, associations representing IAs and RAs highlighted operational difficulties with FDs, such as inconsistent interpretation of third-party FD procedures across banks and challenges in lien-marking.

The decision to allow liquid and overnight mutual funds as alternatives addresses these concerns. SEBI noted that these funds are highly liquid, generally considered low-risk, and less volatile. Crucially, liens can be effectively marked on these mutual fund units. This change will also bring greater efficiency as the operation and invocation of liens will remain within the securities market ecosystem.

Furthermore, opening and operating mutual fund folios can be done digitally, offering significant convenience. This latest measure builds upon previous relaxations introduced by SEBI in December 2024 and March 2025, which included easing eligibility criteria, allowing continuous professional education for certification, removing experience requirements, and replacing net-worth requirements with the deposit system, as well as relaxing fee-related restrictions.

IV. Reforms for Government Entities -

A. Special Measures to facilitate Voluntary Delisting of certain Public Sector Undertakings (PSUs):

Special Measures for Voluntary Delisting: SEBI has approved amendments to its SEBI (Delisting of Equity Shares) Regulations, 2021, to introduce special measures for the voluntary delisting of certain Public Sector Undertakings (PSUs). These measures apply to PSUs (excluding Banks, Non-banking Financial Companies, and Insurance Companies under financial sector regulators) where the combined shareholding of the Government of India and/or other PSUs is 90% or more.

Purpose of PSU Delisting Measures: The goal is to ease the delisting process for these entities, especially those with minimal public float where share prices may not accurately reflect their financial health, making delisting under current norms financially burdensome due to the 60-day volume-weighted average market price rule.

New Delisting Process for Eligible PSUs: Under these new provisions, eligible PSUs will be exempt from the requirement of a two-thirds majority approval from public shareholders for delisting. Instead, delisting will occur through a fixed price process, with the offer price being at least a 15% premium over the floor price. The floor price itself will be determined as the highest of: the volume-weighted average price of acquisitions by the acquirer in the preceding 52 weeks, the highest acquisition price in the preceding 26 weeks, or a price determined by a joint valuation report from two independent registered valuers.

Protection for Public Shareholders in Delisting: To protect public shareholders who do not tender their shares during delisting, any due amounts will be transferred to a designated stock exchange's account for seven years. After this period, any unclaimed funds will be moved to the Investor Education and Protection Fund (IEPF) or SEBI's Investor Protection and Education Fund (IPEF), from which investors can still claim their dues. These proposals were formulated following a public consultation in May 2025 and feedback from the Primary Markets Advisory Committee.

Identified PSUs for Special Delisting Norms: SEBI Chairperson Tuhin Kanta Pandey has confirmed that only five PSUs currently meet the stringent criteria for these special delisting norms. It is crucial to reiterate that these eligible PSUs are specifically outside the banking and financial services sectors, which are subject to different regulatory frameworks.

The identified companies are The Fertilisers and Chemicals Travancore Limited (FACT), HMT Limited (HMT), KIOCL, State Trading Corporation of India Limited (STC), and ITI Limited (ITI). All of these companies are experiencing financial issues and delisting will allow the Government to either privatise or restructure these entities more effectively.

B. Relaxation Of Regulatory Compliances for FPIs Investing Only In Government Securities:

Government’s Cost Of Borrowing To Reduce: The SEBI Board has approved relaxations in regulatory compliance for Foreign Portfolio Investors (FPIs) that exclusively invest in Government Securities (G-Secs), termed "GS-FPIs." This move aims to enhance the ease of doing business and encourage FPI investment in G-Secs, especially given the upcoming inclusion of Indian G-Secs in major global bond indices starting June 2024.

Key Relaxations for GS-FPIs: These changes were formulated after consultation with stakeholders and are expected to significantly boost FPI investments in government securities. The key relaxations for GS-FPIs include:

Less frequent KYC reviews: Harmonizing the periodicity of mandatory Know Your Customer (KYC) reviews with RBI's requirements.

No investor group details: Waiving the requirement to furnish investor group details, which are primarily relevant for equity and corporate debt investments.

Relaxed participation for NRIs, OCIs, and RIs: Permitting Non-Resident Indians, Overseas Citizens of India, and Resident Indians to be constituents of GS-FPIs, including having control, with certain conditions (like LRS for RIs and global fund exposure less than 50%).

Extended timeline for material changes: Allowing GS-FPIs to intimate all material changes within 30 days instead of the previous 7 days.

Impact of Relaxations and G-Secs Index Inclusion: Several global index providers have announced inclusion of G-Secs in their respective bond indices, viz., J P Morgan Global EM Bond Index (starting June, 2024), Bloomberg EM Local Currency Government Index (starting January, 2025) and FTSE Russell Emerging Markets Government Bond Index (starting September, 2025). FPI investment in FAR eligible securities has seen a significant increase and has crossed ₹3 lakh crore mark in March 2025. These measures will likely reduce the cost of borrowing and improve liquidity for the Government.

V. Easing Fundraising Regulations -

A. Simplification and streamlining of Placement Document for Qualified Institutions Placement:

What Are QIPs?: The SEBI Board has approved significant amendments to the ICDR, specifically aimed at simplifying and streamlining the placement document for Qualified Institutional Placements (QIPs) by listed entities. Qualified Institutional Placements (QIPs) are a fundraising tool where listed companies can issue equity shares or other securities to a select group of Qualified Institutional Buyers (QIBs). This method allows companies to raise capital quickly and cost-effectively, bypassing the extensive regulatory procedures of public offerings.

Rationale for Streamlining Disclosures: This initiative mirrors earlier efforts to simplify rights issues for listed companies and is based on the premise that much of the required information for listed entities is already publicly available, thus reducing redundancy. The goal is to provide disclosures in a more summarized and concise form.

Key areas of simplification in the QIP placement document include:

Risk Factors: Disclosure will now focus specifically on risks related to the issue, its objectives, and other material risks, doing away with the need for generic risk factors.

Financial Position: Issuers will only need to provide a summary of their financial position instead of submitting complete financial statements.

Business and Industry Overview: A concise summary of the issuer's business and the industry in which it operates will suffice, rather than extensive detailed descriptions.

Benefits of QIP Process Simplification: This significantly decreases the compliance burden for companies that want to undertake QIPs and increases the speed and flexibility of the QIP process.

B. Enhance Ease of Doing Business for the activities of Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs):

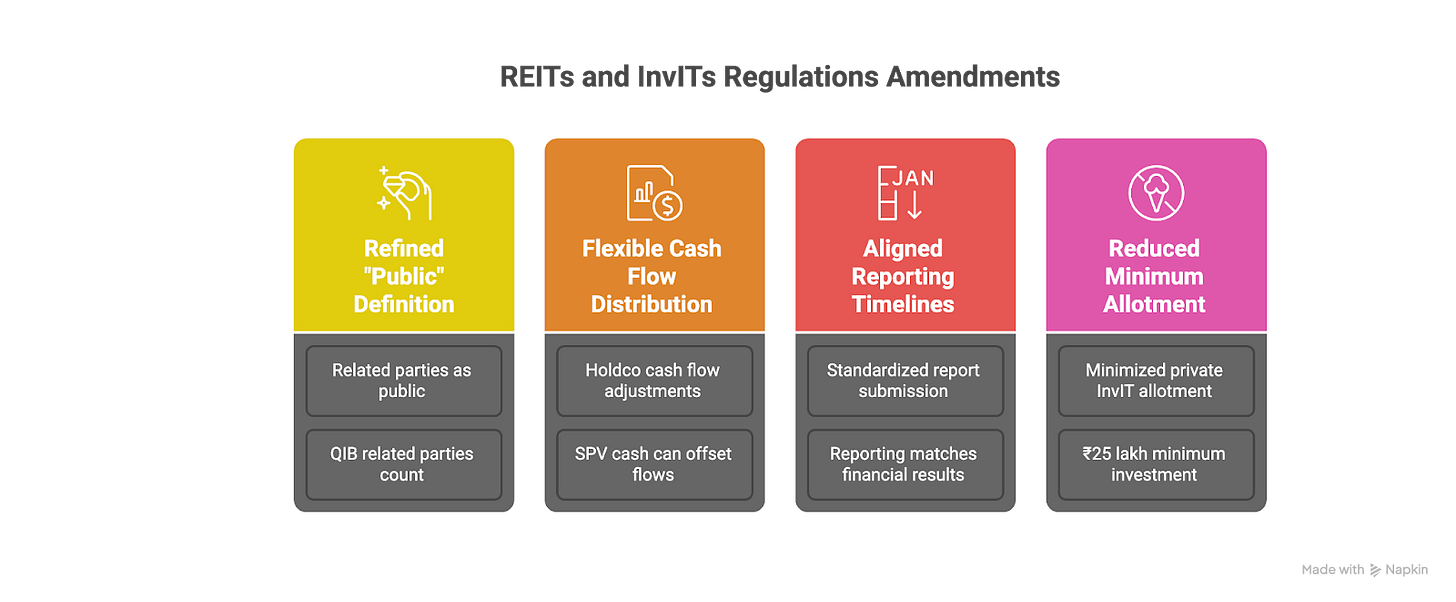

Easing Norms For REITs/InvITs: SEBI has approved several amendments to the REIT and InvIT regulations to enhance the ease of doing business for these investment vehicles. These changes, following public consultations and recommendations, aim to streamline operations and attract more investment. The key amendments include:

Refined "Public" Definition: Related parties of REIT/InvIT, Sponsor, Investment Manager/Manager, and Project Manager will not be considered "public" unless they are Qualified Institutional Buyers (QIBs). However, the Sponsor, Sponsor group, Investment Manager/Manager, and Project Manager are always excluded from the "public" definition, regardless of their QIB status. This change allows units held by QIB-classified related parties to count towards public holdings.

Flexible Cash Flow Distribution for Holdcos: A Holdco can now adjust its own negative net distributable cash flows against the cash received from underlying Special Purpose Vehicles (SPVs) before distributing to the REIT/InvIT, with proper disclosures to unitholders. Previously, Holdcos had to distribute 100% of cash received from SPVs. Prior to this amendment, a HoldCo was required to distribute 100% of the cash flows received from the underlying SPV(s) to the REIT/InvIT.

Aligned Reporting Timelines: The submission deadlines for various reports, including quarterly reports to stock exchanges, trustees, and the board of investment managers, and valuation reports, will now align with the timelines for submitting financial results. This addresses previous discrepancies in reporting schedules.

Reduced Minimum Allotment Lot for Privately Placed InvITs: The minimum allotment lot in the primary market for privately placed InvITs has been reduced to ₹25 lakhs, aligning it with the secondary market trading lot size. This standardizes the minimum investment for all privately placed InvITs.

C. Easing Co-Investment Norms for AIF Investors

Boosting Follow-On Investments: SEBI approved a proposal to allow Category I & II Alternative Investment Funds (AIFs) to offer Co-investment schemes (CIV schemes) directly within their existing structure under the SEBI (Alternative Investment Funds) Regulations, 2012. This move aims to simplify business operations for AIFs and encourage capital formation in unlisted companies.

Defining 'Co-investment' in AIF Context: ‘Co-investment’ means investment made by a manager or sponsor of the AIF or by investors of Category I and II AIFs in unlisted investee companies where such a Category I or Category II AIF(s) makes investment. To illustrate, if a scheme of an AIF is making an investment in a company for, say ₹100 crore, as part of the scheme’s portfolio, on behalf of investors in the pool. If the need of the company is ₹300 crore, the manager of the AIF, may offer this additional investment opportunity to any investor of the scheme of AIF who may want to invest in addition to their investment through the AIF.

SEBI Approval for CIV Schemes in AIFs: The Board has approved a proposal to allow Category I & II Alternative Investment Funds (AIFs) to offer Co-investment schemes (CIV schemes) directly within their existing structure under the SEBI (Alternative Investment Funds) Regulations, 2012. This move aims to simplify business operations for AIFs and encourage capital formation in unlisted companies.

Addressing Operational Challenges: Previously, co-investment opportunities for AIF investors were primarily facilitated through Co-investment Portfolio Managers under PMS Regulations. However, this method presented operational challenges, such as the need for both AIF and PMS registrations for Investment Managers and increased shareholder complexity for unlisted investee companies. To resolve these issues, a working group recommended integrating co-investment within the AIF framework.

Easing AIF Investing: The newly introduced CIV schemes will allow accredited investors of a Category I or II AIF to co-invest in unlisted companies where the AIF scheme is already investing. Key features of this new scheme include:

A separate CIV scheme will be launched for each co-investment in an investee company, with safeguards in place to ensure legitimate use.

Certain regulatory requirements applicable to other AIF schemes will be relaxed for CIV schemes.

Benefits of Integrated AIF Co-investment Structure: This initiative follows a public consultation in May 2025, which garnered significant support and incorporated recommendations from the Alternative Investment Policy Advisory Committee. This new option for co-investment within the AIF structure will complement the existing PMS route, offering greater flexibility and efficiency for AIFs and investors.

SEBI Chairman Tuhin Kanta Pandey has described the ongoing regulatory overhauls as a "spring cleaning" or "Diwali cleaning," aiming to streamline processes and reduce compliance burdens while maintaining regulatory effectiveness. These reforms involve each department collaborating with stakeholders to identify areas for simplification, aligning with the government's broader agenda of deregulation and improving the ease of doing business. This strategy promotes a measured pace of regulatory change, conducive to overall market development.